Write Off Bad Debt Double Entry

Bankruptcy and Divorce One of the most hotly contested issues in divorce proceedings is the division of property and assets but few couples consider what will happen to May 26 2022 4 min read. Goods Distributed as Free Samples.

Writing Off An Account Under The Allowance Method Accountingcoach

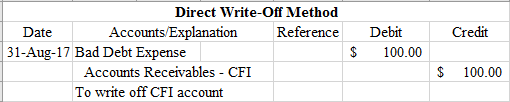

Bad Debt Write Off - A customer has been invoiced 200 for goods and the business decided the debt will not be paid and needs to post a bad debt write off.

. Bankruptcy and Divorce One of the most hotly contested issues in divorce proceedings is the division of property and assets but few couples consider what will happen to May 26 2022 4 min read. 2 Next the Company needs to initiate the following entry to write off the bad debt of customer A. Bad debts should be written off when accounts are made up ix.

The Bad Debts Expense remains at 10000. Another double entry bookkeeping example for you to discover. Get the latest in business tech and crypto on Inside.

The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. A Breaking Bad Movie or simply El Camino is a 2019 American crime thriller filmPart of the Breaking Bad franchise it serves as a sequel and epilogue to the television series Breaking BadIt continues the story of Jesse Pinkman who partnered with former teacher Walter White throughout the series to build a crystal meth empire based in Albuquerque. Considering the manual nature of Excel bookkeeping maintaining a double.

If a business along with its assets and liabilities is transferred by one owner to another the debt so transferred by one owner should be entitled to the same treatment in the hands of the successor. Who Gets the Debt. It is not directly affected by the journal entry write-off.

The main reason that it is recorded as the other. Supplies of food and other necessary things. This system of accounting is different from the double-entry method in which you enter every transaction twice once as a debit and once as a credit.

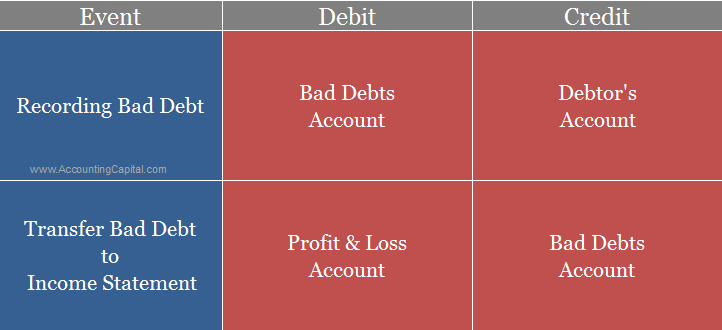

The following accounting double entry will be passed in the books of the company. However we need to understand that bad debt write off is not consistent with the Matching concept. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative.

Debit Bad debts 500 PL. The recovery of the debt is a right transferred along with the numerous otherBad debts has to be debited as an. The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this.

Although it is technically possible to create a double-entry accounting system in Excel we wouldnt advise doing so. The billing to the customers. Trade Debtor Accounts Balance Sheet 2000.

Bad Debts Written Off Income Statement 2000. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Accounting for Funds held in Escrow.

Read the full article on how to write off the account receivable. Write something off definition. To accept that an amount of money has been lost or that a debt will not be paid.

It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss. Bad debt can also result from a customer going bankrupt and being financially incapable of paying back their debts. The act of providing something.

The IRS says that bad debts include loans to clients and suppliers credit sales to customers and business loan guarantees and that a business deducts its bad debts in full or in part from gross income when. The journal entry to record the bad debt recovered is debit cash and credit other income. Last modified November 25th.

Who Gets the Debt. Get 247 customer support help when you place a homework help service order with us.

Writing Off An Account Under The Allowance Method Accountingcoach

Bad Debt Overview Example Bad Debt Expense Journal Entries

Allowance Method For Bad Debt Double Entry Bookkeeping

What Is The Journal Entry For Bad Debts Accounting Capital

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Writing Off An Account Under The Allowance Method Accountingcoach

Comments

Post a Comment